import numpy as np

import matplotlib.pyplot as plt

# Set random seed for reproducibility

np.random.seed(42)

# Configure plotting style

plt.style.use('ggplot')

plt.rcParams['figure.figsize'] = [12, 6]

plt.rcParams['font.size'] = 12Forward and Futures Contracts

Introduction

Forward and futures contracts are fundamental derivatives in financial markets. While they serve similar purposes, they have important differences in their structure and trading mechanisms.

Forward Contracts

A forward contract is a customized agreement between two parties to buy or sell an asset at a specified future date for a price agreed upon today. Key characteristics:

- Private Agreement:

- Traded over-the-counter (OTC)

- Customized terms

- No intermediary

- Settlement:

- Single payment at maturity

- Physical or cash settlement

- No intermediate cash flows

- Counterparty Risk:

- No guarantee mechanism

- Credit risk is a concern

- Default risk must be considered

Futures Contracts

A futures contract is a standardized agreement traded on exchanges. Key characteristics:

- Exchange-Traded:

- Standardized terms

- Highly liquid

- Price transparency

- Settlement:

- Daily marking-to-market

- Margin requirements

- Clearinghouse guarantee

- Risk Management:

- Minimal counterparty risk

- Regular margin adjustments

- Exchange oversight

Understanding Cost of Carry

The cost of carry is a fundamental concept in forward and futures pricing. It represents the net cost of holding an asset over time. Let’s break this down with a practical example.

Example: Agricultural Commodities

Consider a wheat farmer and a flour mill:

- Immediate Purchase (Spot Market):

- Buy wheat today at spot price

- Pay for storage

- Pay for insurance

- Incur financing costs

- Risk of quality deterioration

- Forward Contract:

- Lock in price today

- Delivery in 6 months

- Seller bears storage costs

- No immediate capital outlay

- Quality guaranteed at delivery

Components of Cost of Carry

- Storage Costs:

- Physical storage space

- Handling and maintenance

- Insurance

- Financing Costs:

- Interest on borrowed funds

- Opportunity cost of capital

- Benefits of Holding:

- Convenience yield

- Income (e.g., dividends)

- Quality optionality

def calculate_forward_price(S0, r, q, T, dividends=None):

"""

Calculate forward price using the cost of carry model.

Parameters:

-----------

S0 : float

Spot price

r : float

Risk-free rate (annualized)

q : float

Convenience yield or dividend yield (annualized)

T : float

Time to maturity in years

dividends : list of tuples, optional

List of (amount, time) tuples for discrete dividends

Returns:

--------

float

Forward price

"""

# Basic forward price without dividends

F = S0 * np.exp((r - q) * T)

# Adjust for discrete dividends if provided

if dividends:

for D, t in dividends:

F -= D * np.exp(r * (T - t))

return F

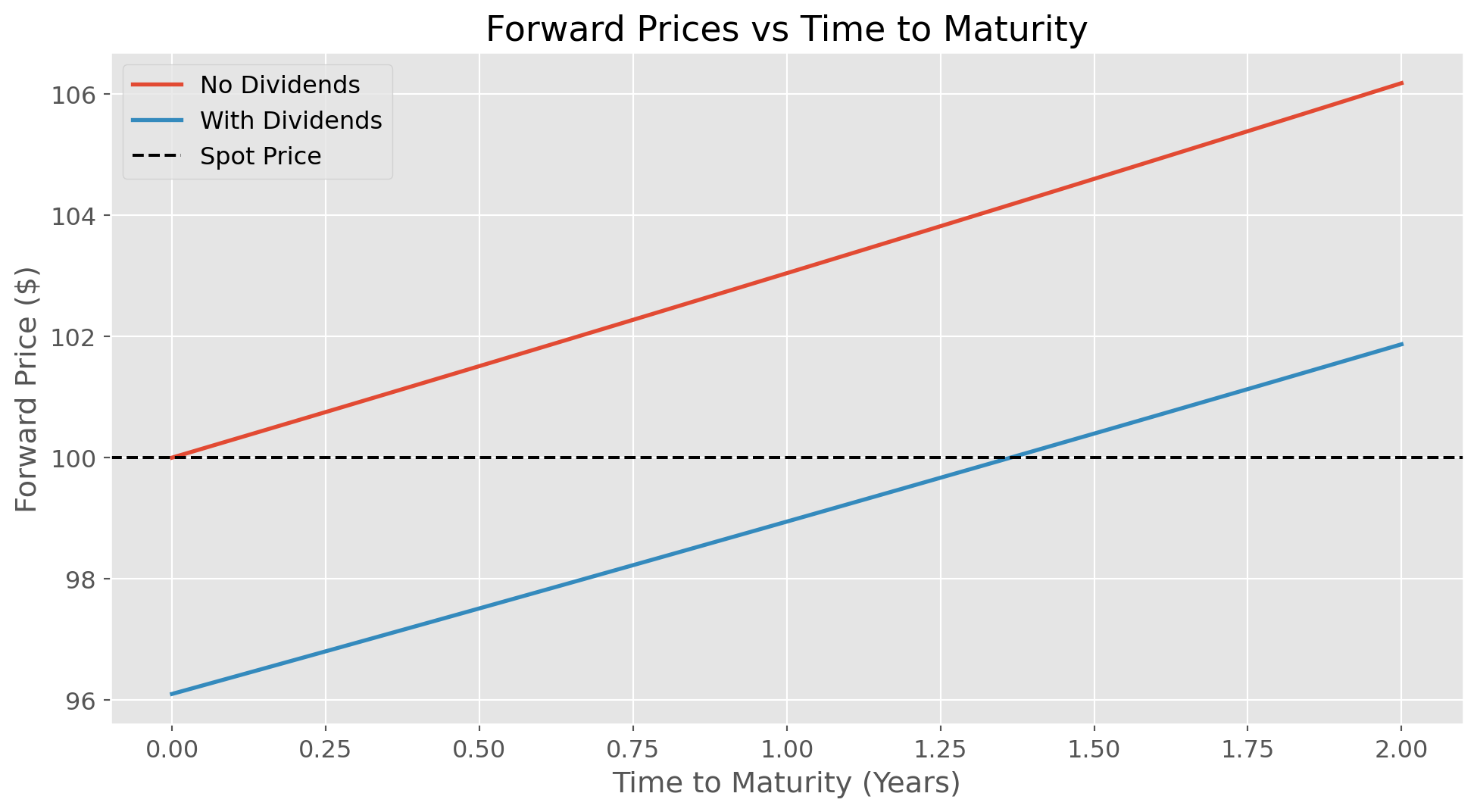

# Example parameters

S0 = 100 # Spot price

r = 0.05 # Risk-free rate (5%)

q = 0.02 # Convenience yield (2%)

T = 1.0 # One year to maturity

# Calculate forward price without dividends

F_no_div = calculate_forward_price(S0, r, q, T)

# Calculate with some discrete dividends

dividends = [(2.0, 0.25), (2.0, 0.75)] # $2 dividend at 3 months and 9 months

F_with_div = calculate_forward_price(S0, r, q, T, dividends)

print(f"Forward Price (No Dividends): ${F_no_div:.2f}")

print(f"Forward Price (With Dividends): ${F_with_div:.2f}")

# Plot forward prices for different maturities

T_range = np.linspace(0, 2, 100)

F_range_no_div = [calculate_forward_price(S0, r, q, t) for t in T_range]

F_range_with_div = [calculate_forward_price(S0, r, q, t, dividends) for t in T_range]

plt.figure(figsize=(12, 6))

plt.plot(T_range, F_range_no_div, label='No Dividends', linewidth=2)

plt.plot(T_range, F_range_with_div, label='With Dividends', linewidth=2)

plt.axhline(y=S0, color='k', linestyle='--', label='Spot Price')

plt.title('Forward Prices vs Time to Maturity')

plt.xlabel('Time to Maturity (Years)')

plt.ylabel('Forward Price ($)')

plt.legend()

plt.grid(True)

plt.show()Forward Price (No Dividends): $103.05

Forward Price (With Dividends): $98.94

Forward Price Formula and Its Components

The forward price formula is derived from the principle of no-arbitrage and incorporates several key components:

Basic Formula

The forward price \(F\) for an asset with spot price \(S_0\) is given by:

\[F = S_0 e^{(r-q)T} - \sum_{i=1}^N D_i e^{r(T-t_i)}\]

where: - \(F\) is the forward price to be paid at time \(T\) - \(S_0\) is the current spot price - \(r\) is the risk-free interest rate (continuous compounding) - \(q\) is the continuous dividend yield or convenience yield - \(T\) is the time to maturity in years - \(D_i\) is a discrete dividend paid at time \(t_i\) where \(0 < t_i < T\)

Key Components Explained

- Spot Price (\(S_0\)):

- Current market price of the asset

- Starting point for forward pricing

- Risk-Free Rate (\(r\)):

- Opportunity cost of funds

- Usually based on government securities

- Assumed to be constant for simplicity

- Dividend/Convenience Yield (\(q\)):

- Continuous yield from holding the asset

- For stocks: dividend yield

- For commodities: convenience yield

- Time Factor (\(T\)):

- Time to maturity in years

- Affects the compounding of carrying costs

- Discrete Dividends (\(D_i\)):

- Known dividend payments

- Adjusted for time value of money

- Reduces the forward price

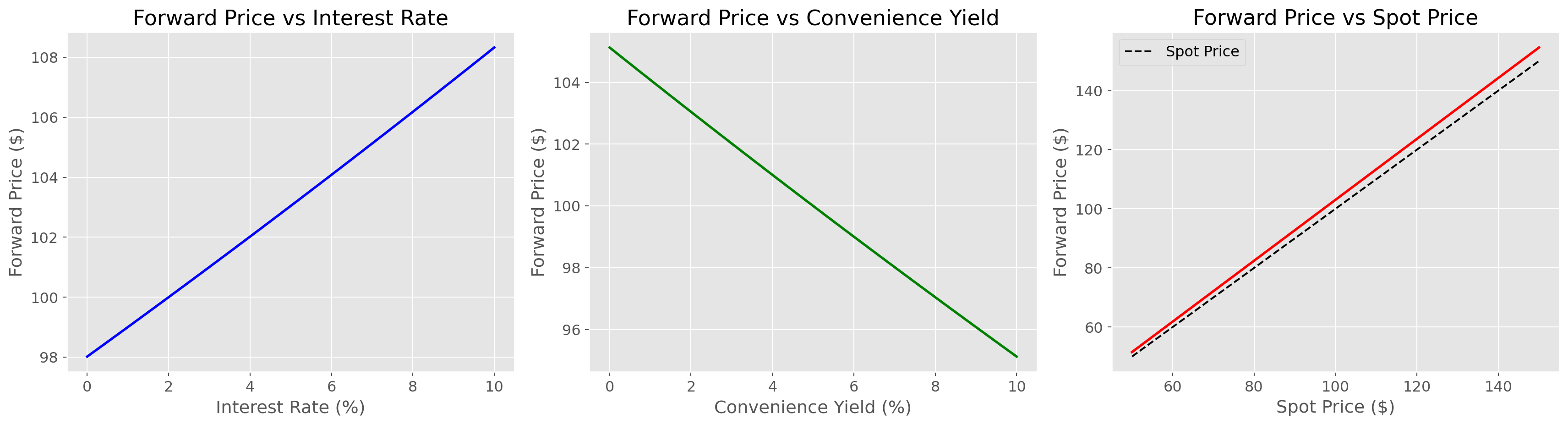

def analyze_forward_price_sensitivity(S0=100, r=0.05, q=0.02, T=1.0, dividends=None):

"""

Analyze how forward prices change with different parameters.

Parameters are same as calculate_forward_price function.

"""

# Parameter ranges

r_range = np.linspace(0, 0.1, 50) # 0% to 10%

q_range = np.linspace(0, 0.1, 50) # 0% to 10%

S0_range = np.linspace(50, 150, 50) # $50 to $150

# Calculate sensitivity to interest rates

F_r = [calculate_forward_price(S0, r_i, q, T, dividends) for r_i in r_range]

# Calculate sensitivity to convenience yield

F_q = [calculate_forward_price(S0, r, q_i, T, dividends) for q_i in q_range]

# Calculate sensitivity to spot price

F_S0 = [calculate_forward_price(S0_i, r, q, T, dividends) for S0_i in S0_range]

# Create subplots

fig, (ax1, ax2, ax3) = plt.subplots(1, 3, figsize=(18, 5))

# Plot sensitivity to interest rate

ax1.plot(r_range * 100, F_r, 'b-', linewidth=2)

ax1.set_title('Forward Price vs Interest Rate')

ax1.set_xlabel('Interest Rate (%)')

ax1.set_ylabel('Forward Price ($)')

ax1.grid(True)

# Plot sensitivity to convenience yield

ax2.plot(q_range * 100, F_q, 'g-', linewidth=2)

ax2.set_title('Forward Price vs Convenience Yield')

ax2.set_xlabel('Convenience Yield (%)')

ax2.set_ylabel('Forward Price ($)')

ax2.grid(True)

# Plot sensitivity to spot price

ax3.plot(S0_range, F_S0, 'r-', linewidth=2)

ax3.plot(S0_range, S0_range, 'k--', label='Spot Price')

ax3.set_title('Forward Price vs Spot Price')

ax3.set_xlabel('Spot Price ($)')

ax3.set_ylabel('Forward Price ($)')

ax3.legend()

ax3.grid(True)

plt.tight_layout()

plt.show()

# Run sensitivity analysis

print("Analyzing Forward Price Sensitivity to Various Parameters...")

analyze_forward_price_sensitivity()Analyzing Forward Price Sensitivity to Various Parameters...

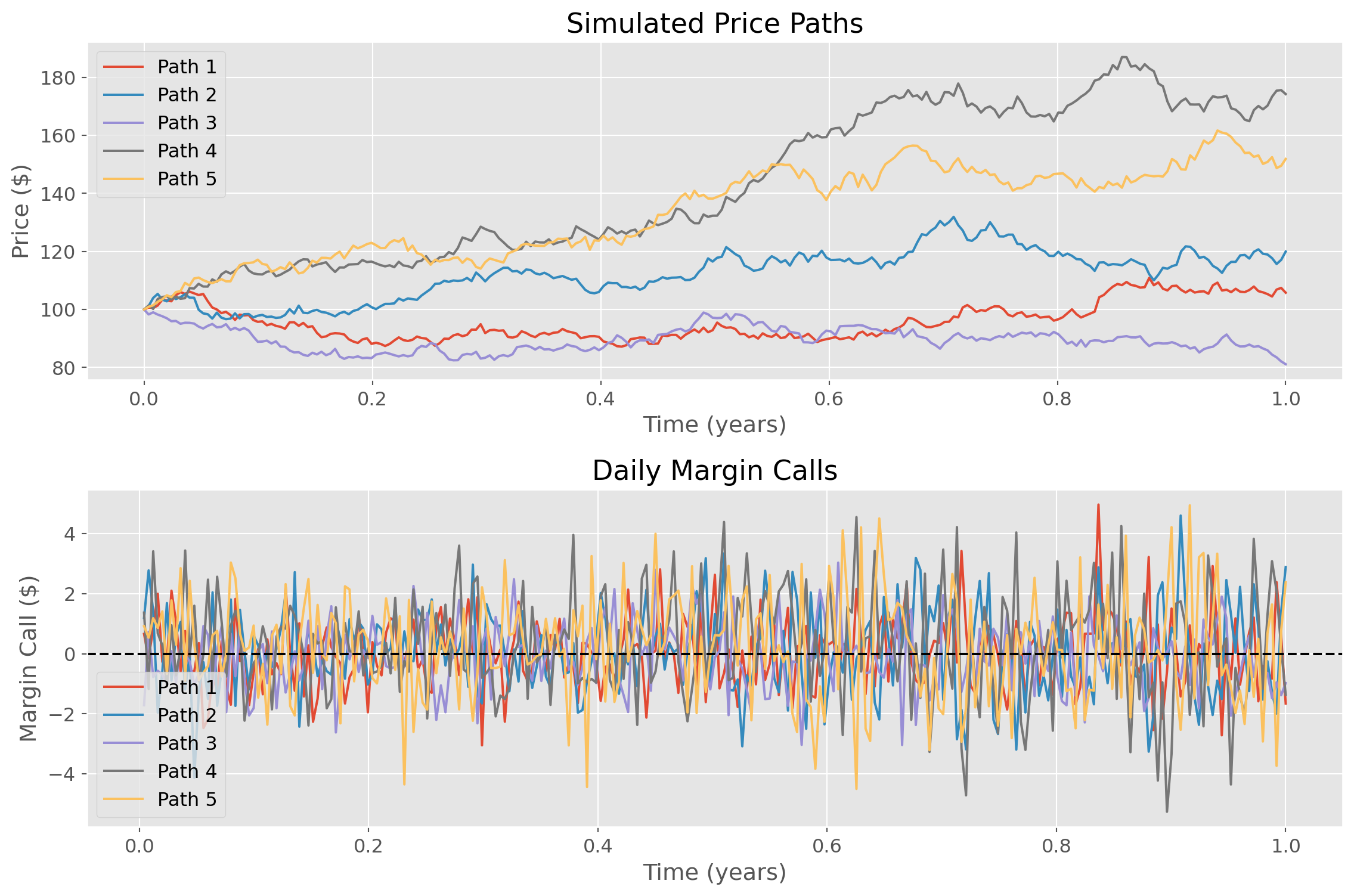

def simulate_futures_margin(S0=100, mu=0.1, sigma=0.2, T=1.0, n_steps=252, n_paths=5):

"""

Simulate futures margin calls using geometric Brownian motion for the underlying.

Parameters:

-----------

S0 : float

Initial spot price

mu : float

Drift rate (annualized)

sigma : float

Volatility (annualized)

T : float

Time to maturity in years

n_steps : int

Number of time steps (trading days)

n_paths : int

Number of paths to simulate

"""

# Time grid

dt = T/n_steps

t = np.linspace(0, T, n_steps)

# Initialize arrays

S = np.zeros((n_paths, n_steps))

S[:, 0] = S0

# Simulate price paths

for i in range(n_paths):

for j in range(1, n_steps):

dW = np.sqrt(dt) * np.random.normal()

S[i, j] = S[i, j-1] * np.exp((mu - 0.5*sigma**2)*dt + sigma*dW)

# Calculate daily margin calls

margin_calls = np.diff(S, axis=1)

# Plot results

plt.figure(figsize=(12, 8))

# Plot price paths

plt.subplot(2, 1, 1)

for i in range(n_paths):

plt.plot(t, S[i], label=f'Path {i+1}')

plt.title('Simulated Price Paths')

plt.xlabel('Time (years)')

plt.ylabel('Price ($)')

plt.legend()

plt.grid(True)

# Plot margin calls

plt.subplot(2, 1, 2)

for i in range(n_paths):

plt.plot(t[1:], margin_calls[i], label=f'Path {i+1}')

plt.title('Daily Margin Calls')

plt.xlabel('Time (years)')

plt.ylabel('Margin Call ($)')

plt.axhline(y=0, color='k', linestyle='--')

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Print summary statistics

print("\nMargin Call Statistics:")

print(f"Average Daily Margin Call: ${np.mean(margin_calls):.2f}")

print(f"Max Positive Margin Call: ${np.max(margin_calls):.2f}")

print(f"Max Negative Margin Call: ${np.min(margin_calls):.2f}")

print(f"Standard Deviation: ${np.std(margin_calls):.2f}")

# Run simulation

print("Simulating Futures Margin Calls...")

simulate_futures_margin()Simulating Futures Margin Calls...

Margin Call Statistics:

Average Daily Margin Call: $0.11

Max Positive Margin Call: $4.97

Max Negative Margin Call: $-5.27

Standard Deviation: $1.48